Hugo Boss

Hugo Boss is globally recognized. Why is that? What value does Hugo Boss bring to its customers, why do they keep coming back, and why do they pay premium prices? In the end, these are just clothes. Let’s unpack.

Hugo Boss was founded by Hugo Ferdinand Boss and has its beginnings in the early 1920s in Germany. Hugo Ferdinand Boss was born in 1885 in a small German town called Metzingen. To this very day, the company's HQ remains rooted in this town and it isn’t Germany’s version of Paris, London, or New York; it has 23,000 inhabitants – not exactly metropolitan. Regardless, Hugo F. Boss starts his career in 1902 at a color-weaving mill in Metzingen, where he gains his first experiences in the clothing industry. In 1903, at the age of 18, he is drafted into military service, and after his release from service in 1905, he finds a job in a weaving mill in Konstanz, Germany. Three years later, in 1908, and after the death of his parents, Hugo moves back to Metzingen and takes over the manufactured goods business his parents leave behind. The same year, the young man gets married, out of which daughter Gertrud emerges, who later in 1931 marries the businessman Eugen Holy. Eugen Holy would later join the company in 1931, during the depression, and together with Hugo’s son, Siegfried Boss, eventually take over the company when Hugo dies in 1948.

So it’s the early 1920s, and the small company offers all sorts of products from men's fabrics to shirts, underwear, and bridal dresses. Have a look at the company’s first-ever advertisement:

(it reads: men's fabrics, women's dresses, blouse fabrics, damasks, bedding and seats, linen and half-linen, cotton cloths, cotton fianelles, aprons, hosiery, collars, shrimps, corsets, ready-made blouses, ready-made men's and women's underwear, sheets, bed feathers and fluff. Specialties: Making full beds and bridal outfits.)

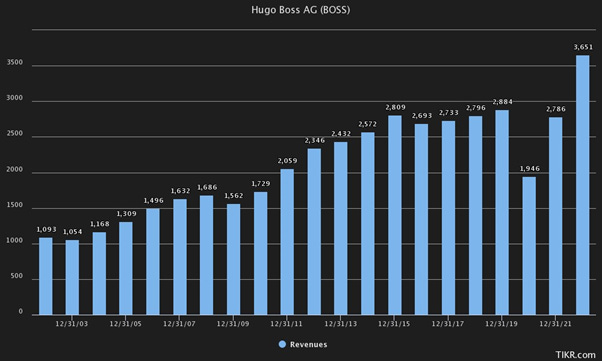

It's clean but not exactly groundbreaking marketing work. Anyways, Hugo expands into the production of professional and work clothing and grows the workforce to around 20 employees by the end of the 1920s. But financially, the company is struggling and in 1931, Hugo Boss has to file for bankruptcy, but by an agreement with creditors, he is able to keep production going. Things are picking back up again in the 1930s and during WW2, the company starts mainly producing uniforms for the SA, SS, Hitler Jugend, and the Wehrmacht, but also for postal and railway employees. Have a look at another stroke of marketing genius:

At the top, it says “SA, SS, HJ Uniforms”, then below that they offer “working, sport, and rain clothing,” and at the bottom, it even states that they are an officially licensed company of the SA and SS - now that’s giving it some boost.

From the beginning of the 1930s to the end of the war, the company keeps growing like a train. Have a look at their archived sales figures. It has two revenue columns and annoyingly the archives don’t explain the discrepancies. In any case, you can see the company is exploding.

So during the war, Hugo Boss employes around 300 people, but in order to meet increasing demand, the company is assigned 40 prisoners of war and around 150 forced laborers to the workshop. During that time, it doesn’t just produce uniforms but also continues to produce workwear, sportswear, and rainwear. And although the company produces more and more uniforms for various government organizations, that growth does not spell over to the other lines of business. So that after the end of WW2, Hugo Boss takes up the production of work and professional clothing again in 1945 but with a much smaller staff of around 20 employees. At that time, due to his health, Hugo only operates as a deputy managing director all the way until finally in 1948, his son Siegfried and son-in-law Eugen Holy take over the company. Hugo Ferdinand Boss dies in 1948 at the age of 63.

So it’s 1948, and Eugen and Siegfried are now at the helm of the company, and they need to rebuild the company. What to do? Back to where they left, just now for the winning side. Their production initially focuses on uniforms for the French Army and the French Red Cross, then on uniforms for the postal service, railway workers, and policemen. So that at the beginning of the 1950s, the company is back to 120+ employees and that number would continue to grow over the coming years. These early 50s would be crucial for the company’s future. It is the year 1953 when the very first BOSS men’s suit hits the market, but it isn’t until the late 1950s that the company starts taking on commissioned work for men's suits.

In the 1960s, the true foundation for name Hugo Boss is laid as the company starts the production of the first men's suits in series, transforming the craftsmen business into a proper medium-sized production company. But even with product expansion and success and despite sales of around 3.5 million DM, the company was in financial trouble and was about to close at the end of the 1960s. Come the year 1969, and a significant change in leadership occurs. Jochen and Uwe Holy, sons of Eugen Holy and grandchildren of Hugo Ferdinand Boss, take over the company in the 3rd generation and gradually begin to shape the company into the international fashion group it is today.

The two brothers open their first Hugo Boss factory outlet in a warehouse not far from the factory premises in 1972, which over the years has developed into Outletcity Metzingen. In the same year, the company starts its motorsport sponsorship activities under the BOSS brand by sponsoring racing driver Jochen Mass, thus starting to address an international audience and supporting the worldwide awareness of the BOSS brand. In 1975, the two men hire the Austrian designer Werner Baldessarini, who eventually rose to become the chief designer; and two years later, in 1977, the BOSS trademark was officially registered.

It is the 1980s when the company and its BOSS brand really starts to explode. Sponsorship contracts with athletes and legends such as Ayrton Senna and Niki Lauda are made, but also with other F1 drivers such as Alain Prost, Nigel Mansell, and Bernhard Langer in Golf, making the brand more and more internationally known. From 1984 to 1989, Boss outfits actors Don Johnson and Jan-Michael Phillip in the then-popular TV series Miami Vice. Also in the 1980s, the company starts outfitting the actors of the law series L.A. Law, a popular US show.

During that time, the company starts milking the brand cow. Boss starts granting licenses to external companies to produce perfumes (Eurocos Cosmetic/Procter & Gamble) and glasses (Charmant), and leather goods for the first time. We’ll come back to the economics of these later, but it's beautiful.

In 1985, the company goes public on the Frankfurt Stock Exchange, and in 1989, the two brothers sell their 54.5% stake to the Japanese real estate company Leyton House, which was also involved in international motorsports, including Formula 1 (Leyton-House/March). Now, this is great: Leyton House chief executive was Akira Akagi. Akagi gets arrested in 1991 for being instrumental in the largest credit fraud in Japanese history, and it is said that he has had contacts with the Yakuza, the Japanese mafia. You can’t make this stuff up.

From Italy to Private Equity and Back

So in 1991, the Italian Family Marzotto, owners of Gianfranco Ferrè, Missoni, Marlboro Classics, takes a majority stake in Hugo Boss, and two years later in 1993, the Boss collections and brand is divided for the very first time. Into three different lines: BOSS for the more serious, elder, success-oriented man, HUGO an avant-garde line for the younger clientele, and the upscale men's line Baldessarini, named after the Austrian chief designer. The Baldessarini line was later discontinued and sold in 2006 – I guess it wasn’t BOSS or HUGO enough. It’s not easy to build an iconic brand, that’s for sure. Werner Baldessarini was the chief designer from 1975 to 1997, and he was also CEO of the entire company from 1998 to 2002, but we’ll come back to that later.

In 1995, Boss started licensing its brand for high-end shoes, which later in 2004 the company brought in-house, integrating the production of shoes and leather accessories into its own business and expanding this product group altogether. In 1996, a BOSS watch license was given, a year later, the BOSS Golf line was set up, a sportswear line tailored specifically for the use of golf. BOSS Golf later in 2002 converted into Golf Green. In 1998, BOSS introduced a women's collection for the first time under the name Hugo Woman.

And as if that’s not enough, there comes a stretch between 1999 and 2017 ( the year when things get consolidated back again) where the company starts setting out new line after new line: BOSS Orange (leisure) in 1999, BOSS Womenswear in 2000, BOSS Green (Golf) in 2003, BOSS Selection (high-end luxury) in 2004, BOSS Orange Womenswear in 2006, BOSS Selection Tailored Line in 2009 which later merged into BOSS MADE TO MEASURE in 2011, BOSS HOME in 2011, a line of bed linen, bath, and beach towels although under licensing. Wow, that’s a lot of lines. Until finally, in 2017, the company decides to go with a two-brand strategy only: HUGO and BOSS. Clean and simple. The BOSS Orange and BOSS Green lines were consolidated back into the BOSS core brand with the spring/summer 2018 collection.

Before moving on, I want to take a look back once more. Back in 2002, the Marzotto Family, the majority owner of Hugo Boss, acquires the Italian fashion brand Valentino. This leads to the founding of the Valentino Fashion Group in 2005 with the brands Gianfranco Ferrè, Hugo Boss, Missoni, and Marlboro Classics in the portfolio. Two years later, in 2007, Valentino is taken over by UK private equity firm Permira and Hugo Boss as part of it. But Boss is spun off again from the Valentino Fashion Group in 2015, and Permira sells its shares to institutional investors but also back to our friends, the Marzotto family. Got to love these PE guys. Today the Marzotto family holds about 15% of the company.

It’s interesting to see the two brothers, grandsons of Hugo F. Boss, Uwe Holy and Jochen Holy, leave the company in 1993. They are the ones who built the business into the multinational, recognized brand it is today. “We're selling zeitgeist," Holy once said, and with this concept, the men's outfitters boosted their Group from annual sales of 3.5 million Deutsch Mark at the end of the 1970s to 922 million Deutsch Marks in the year 1990. They were the ones breaking into F1 and into Golf, into American TV shows, started licensing out the brand into perfumes and glasses which eventually would be extended into shoes, leather goods, and watches. They were the ones who hired Austrian designer Werner Baldessarini.

After the two men leave, a string of managers take helm at the company, none lasting particularly long. In 1993, the year the two men leave, Peter Littmann takes over. Peter is the one introducing the three-brand strategy. As mentioned, in addition to the core BOSS brand, the Hugo line (casual) and the Baldessarini line (high-end), are introduced. Littmann is also responsible for relocating part of the production abroad and driving further internationalization of the business. After only 4 years in 1997, even before his official contract ends, he leaves the company. Boss owner Pietro Marzotto, an Italian textile mogul, was annoyed by Littmann's cocky manner, who always announced great visions but neglected the detailed work, who was constantly on the road with a chauffeur in the company car, in a charter jet at the company's expense, driving around in a Porsche, smoking expensive cigars, and sunbathing in the light of camera flashes. He had to go.

So Littmann is out, and in comes as the new CEO Werner Baldessarini, who has been chief designer for the company over many years. Werner Baldessarini advances into sportswear and more casual clothing with Boss Orange as the successor collection to the discontinued Boss Sport line and helps the Golf line, which had already been introduced in 1997, to be successful. In 2000, he brings Boss Woman to the market, a women's collection produced in Milan (Italy) by the German designer Grit Seymour, which initially made heavy losses and slowly became successful in 2002 after a repositioning with a design team in Metzingen, Germany.

In 2002, Baldessarini leaves, and Bruno Sälzer, who has been Chief Sales Officer since 1995, takes over. Sälzer lasts six years, and he positions the company as a lifestyle brand, saves the women's line Boss Woman, and further promotes international expansion. To Sälzer's credit, when he takes over, the company has sales of €1.1 billion with operating profits of around €100 million. By the time he leaves in 2008, sales are at €1.7 billion, and operating profits are around €230 million. Not bad.

As described before in 2005, Marzotto spins off its clothing and fashion activities into the Valentino Fashion Group, including Hugo Boss' majority shareholding. In 2007, Valentino is taken over by the leverage buyout firm Permira, thereby giving Permira significant influence over Hugo Boss. Sälzer leaves the company in 2008 due to clashes with Permira on the growth trajectory and profitability of the company, but also due to a special dividend of €345 million in favor of Permira. In order to pay for the dividend, the company had to take on debt. Permira gets its way and in mid-2008 appoints former Louis Vuitton and Christian Dior manager Claus-Dietrich Lahrs as CEO of Hugo Boss. Under Lahrs, the company grows from €1.7 billion in sales and operating profits of around €230 million in 2008 to €2.8 billion in sales and operating profits of around €470 million in 2015, the last year where Lahrs is fully in charge. Lahrs also hires New York based Taiwanese designer Jason Wu to be responsible for BOSS Womenswear and accessories. Yes, there was exposure to high end fashion, but the real growth just wasn’t there for Womenswear. Interestingly, during Lahrs’ tenure as CEO, from 2008 to 2015, gross profit margins expand from around 54% to around 66%. I wonder what magic he worked there – we will get to that later. He leaves in February 2016 without a successor being announced. It is said that the reasons for his departure were sales difficulties in the USA and China, the unsuccessful attempt to position Hugo Boss in the luxury segment, the high expenses for the women's line, and a massive expansion of the branch network. But nobody knows. In mid-2016, CFO Mark Langer was appointed as the new CEO and was succeeded in June 2021 by Daniel Grieder, who is still leading the company today.

Looking Under the Hood

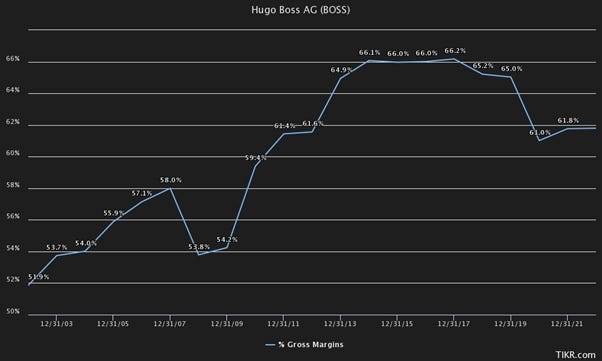

In the last financial year 2022, the company generated revenues of €3.65 billion. 20 years earlier, in 2002, that revenue stood at €1.1 billion, which means that the company grew its sales by roughly 6% CAGR over that period, which is certainly better than that of most western countries GDP growth but certainly far from mind-blowing. Take in contrast to that the period before the 2000s. Back in 1996, sales stood at around €500 million, so it doubled in six years, now that’s growth.

Of that €3.7 billion in revenue, 63% was generated in Europe, Middle East, and Africa, 22% in the Americas, and 13% in Asia/Pacific. 2% comes from licensing, with €93 million. That geographic split has not dramatically changed over the past 20 years. In 2005 when the data is first split out, EMEA made 70% of all sales, so Americas and Asia/Pacific have taken the same share over the years, but nothing drastic.

What’s definitely worth highlighting here is that these licensing revenues that have their beginnings in the 1980s with Hugo’s two grandsons are incredibly profitable, with 84% operating profit margins attached to them. The company generates $77 million in operating profits in 2022 from licensing alone, more than with their product sales in the entire region of Asia/Pacific. Beautiful. What you can see through the numbers is that the brand clearly does not carry the same weight in the Americas and Asia as it does in Europe, which to a degree is a reflection of the company’s history and path of expansion.

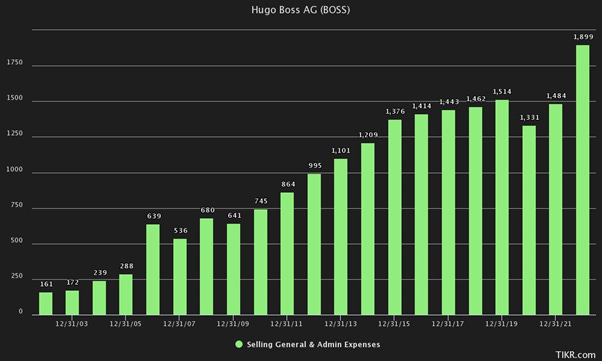

Moving on, an interesting trend has emerged over the last 20 years, and it has to do with profitability, particularly gross profit margins. Have a look at the chart below:

That’s an expansion of gross margins by almost 15%. That’s huge. There were two drivers to this. One was better sourcing and manufacturing efficiencies, but that’s minor. What was more important was the following. It was in the early 2000s that the company decided to really lean into its own retail business and expand that across the globe. That is really the factor that over the years has had the largest impact on gross margins as it gradually shifted more and more sales from wholesale to own retail stores. At own retail, the company would directly operate stores; they set pricing here themselves and they simply run lower discounts at these points of sale. They control that entire point of sale vs. wholesale. The location, the fit-out, the design, the lease terms, pricing, stock, the sales staff, etc. (except in shop-in-shops). And this channel includes everything from freestanding stores, shop-in-shops, and outlets. To give you a feel of how aggressive the company grew the expansion of the directly operated stores: in the year 2000, Hugo Boss was running 37 own stores; by 2005, that grew to 145 stores. Eight years later in 2013, that grew to a whopping 1,010 stores, and as of the end of 2022, Hugo Boss had 1,316 own retail points of sale.

And the result of this aggressive expansion? In the year 2005, 77% of all the company’s sales were generated through the wholesale channel, and only 20% through the own retail business. By the year 2022, that has changed dramatically. Only 25% was generated through the wholesale channel, and a whopping 55% through own stores. The remaining gap is filled with online sales and the licensing business. So from a gross profit perspective, yes, margins have increased significantly since the beginning of the millennium. And by the way, the aggressive expansion of the own retail business is also responsible for practically all of Hugo Boss’ sales growth over the past 20 years. In 2004, wholesale revenue stood at €895 million, in 2022, that figure stood at exactly the same number, no joke, to the million, €895 million. Revenue from the own retail business, however, grew from €234 million in 2004 to €2.0 billion in 2022, that’s a 10x increase. Go-to-market and channel strategy apparently matters.

But at the end of the day, a gross margin is just an intermediate step, a means to an end for the actual end goal: Profits. So has that massive improvement helped the bottom line? Have a look at the chart below:

Operating margins did, in fact, improve, especially from 2002 to 2013. There is an improvement from around 10% to almost 20%. But then margins started slipping from 2015 onwards, and they have not recovered back up to their previous highs. So now, in the year 2022, we are back to exactly where we started 20 years ago, at around 10%. The factor causing that decline in operating profits is the same one that has caused the revenue growth and improvement in gross margins: the aggressive growth in the own retail business and the associated operating costs to run them. See the progression of SG&A costs over the past 20 years:

SG&A expenses have grown by more than 10x over that time period, whereas overall sales only grew by 3.3x. Of course, the bottom-line profitability will suffer. Well, you could think some of that is because of bloated overheads and admin functions, and there is an element of that. In the last financial year 2022, admin expenses were 10.5% of sales. In 2016, they were 10.0%, in 2013 9.4%, 10.9% in 2010, and 11.7% in 2008. So, it's been broadly flat over the past 15 years. The classification of costs and the reporting were different prior to 2009, so we can’t go much further back. Although, when I do an approximation by taking the pure general and administration costs and adding the total employee costs that are in admin functions (though that’s a proxy as well), in the year 2005, I get around the 5% mark. So, admin costs have increased as a percentage of sales from the early 2000s, but what are you expecting? Adding 1,000+ points of sales is no picnic; that ship needs to be administered, particularly when comparing that to a time in the early 2000s when the company was predominantly selling through the wholesale channel.

And perhaps that’s a lesson learned here. Yes, you may not have the same pricing power in wholesale, and yes, you are running lower gross margins, but equally, you have none of the associated costs of running a shop yourself. A wholesaler is making use of scale economies; they have personnel and square footage that they can spread over multiple products and brands, which gives them a scale/cost advantage.

On the other hand, it’s clear from the numbers that Hugo Boss’ revenue and therefore profit growth was entirely fueled by taking the point of sales into their own hands, rolling out more than 1,300 globally over a 20-year period. That ultimately was the source of additional profits for the company over the past 20+ years.

The Gravitational Field

But one question remains. Can you take any brand and just go from 30 own point of sale stores to over 1,300 in 25 years? I think the resounding answer to that is no. An own point of sale requires a pull from customers, a brand that has its own gravitation field. A customer who is seeking out your particular brand. It needs to be a brand that has an emotional attachment with the customer so much so that he is willing to spare his time and go seek a location that is fully dedicated to only showcasing that one particular brand. Hugo Boss has nurtured that brand over decades. That is not something you can replicate over a couple of years. The name “Hugo Boss” rings “very good suit”, it rings “success” from Senna and Lauda in F1 to Klitschko in boxing. That’s been cultivated over decades, like Pavlov’s dogs. The name has been passed on from the collective societal Grandfather to son, from son to grandson. Everyone in Germany, and perhaps in the western hemisphere, will know of Boss, particularly when it comes to suits. And the company leverages this share of mind into other men’s categories moving it away from the suits business. BOSS Menswear, to this day, makes up 79% of all sales.

Buying Hugo Boss as a man, exudes confidence; it exudes “I have success in whatever I am doing”. It’s an association with success. And that’s the real value addition that this business brings to its customers and people are willing to pay a premium to be part of the “success-club”. It’s not just about covering your skin. It’s an emotional state and a particular message to the outside world. It may perhaps not be the most stylish of all wear, but everyone will recognize that this is “quality” and thus recognise your choice as such. It's hard for a man to go for the HUGO BOSS brand and “make a mistake”. At the end of the day, it is a safe bet.

That’s hard to replicate.

If you enjoyed this episode, please subscribe.